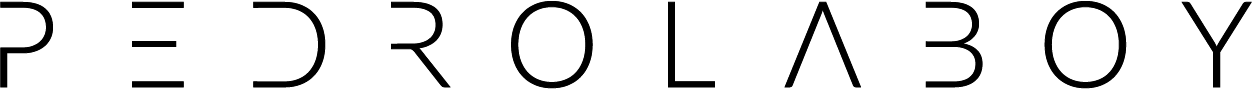

The relationship between available inputs and desired outputs will determine the appropriate machine learning or artificial intelligence models.

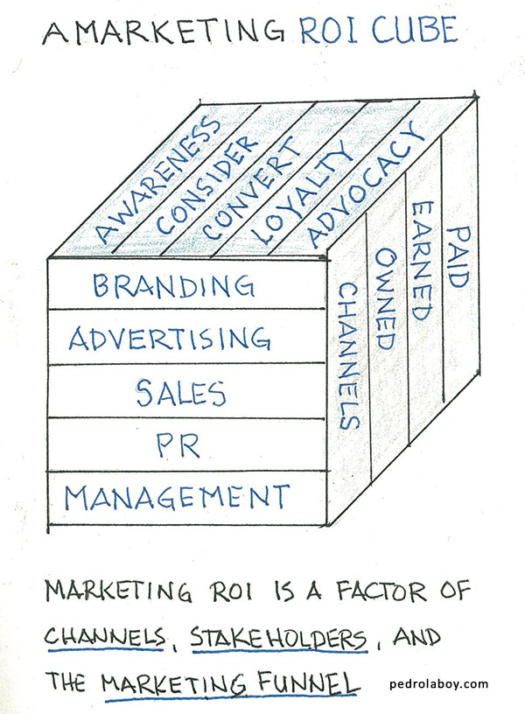

Notebook Thoughts: The Modern Marketing Science Team

Today, data science is evolving into a new discipline that I like to call “marketing science.” The modern marketing scientist possesses multidisciplinary skills that include mathematics, technology and business expertise.

Notebook Thoughts – The Evolution of Media Measurement

How we track and measure the effectiveness of media has evolved significantly over the past 70 years. From a sole focus on reaching eyes and ears during the golden years of print, radio and TV to counting eyeballs and clicks during the 90s and 2000s to reach to measuring reach, response and relationships in today’s interconnected age.

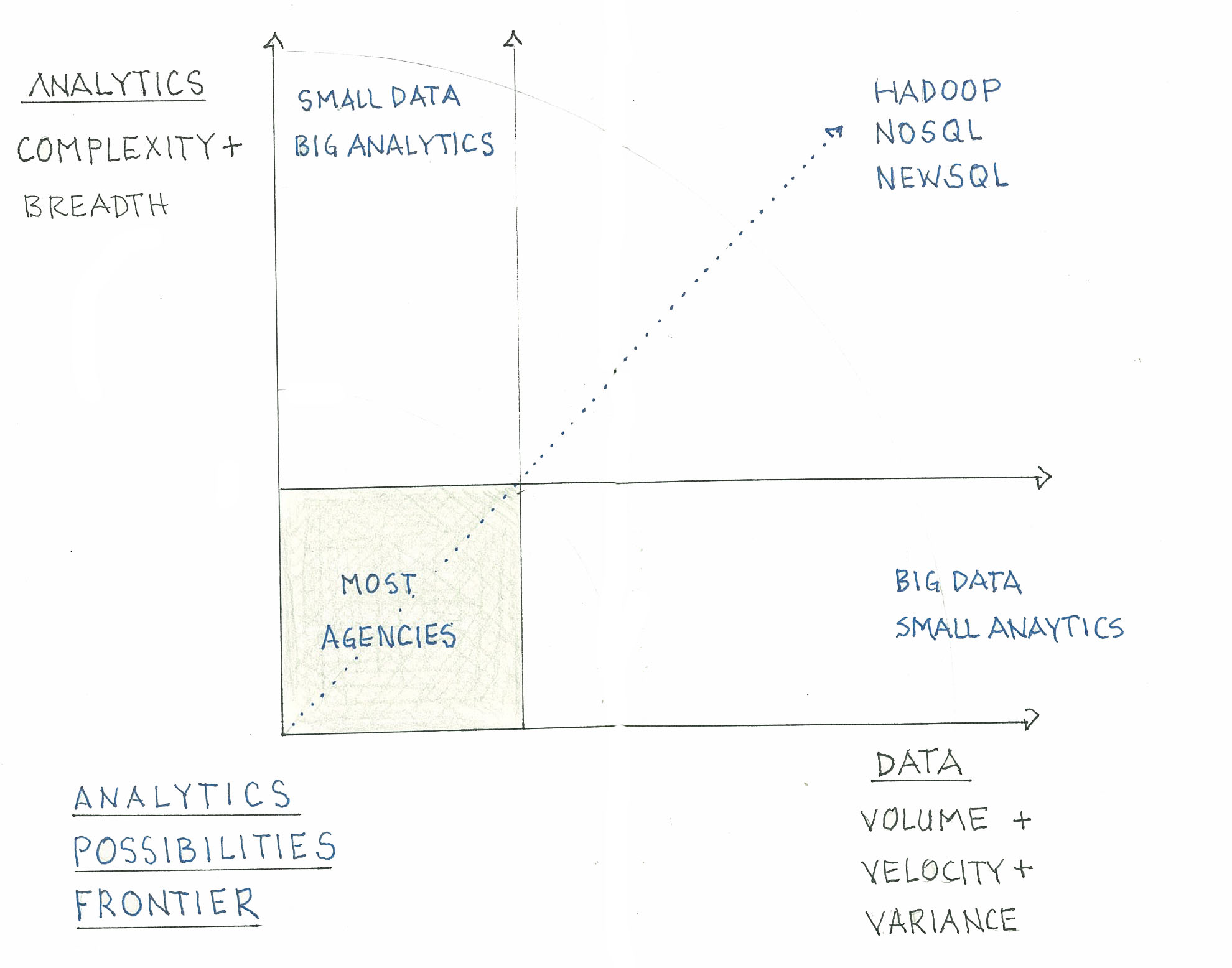

Notebook Thoughts – The Analytics Possibilities Frontier

The benefits an enterprise will derive from Big Data will be determined by its ability to manage, connect and interpret data. That is, having place in the people, process and technology to apply advanced analytics (i.e. predictive, prescriptive) to complex data (i.e. velocity, veracity, volume).

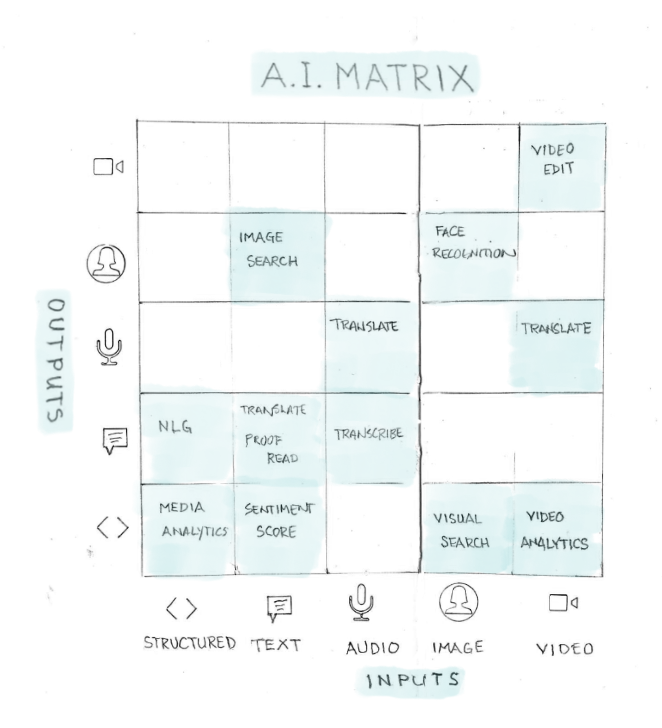

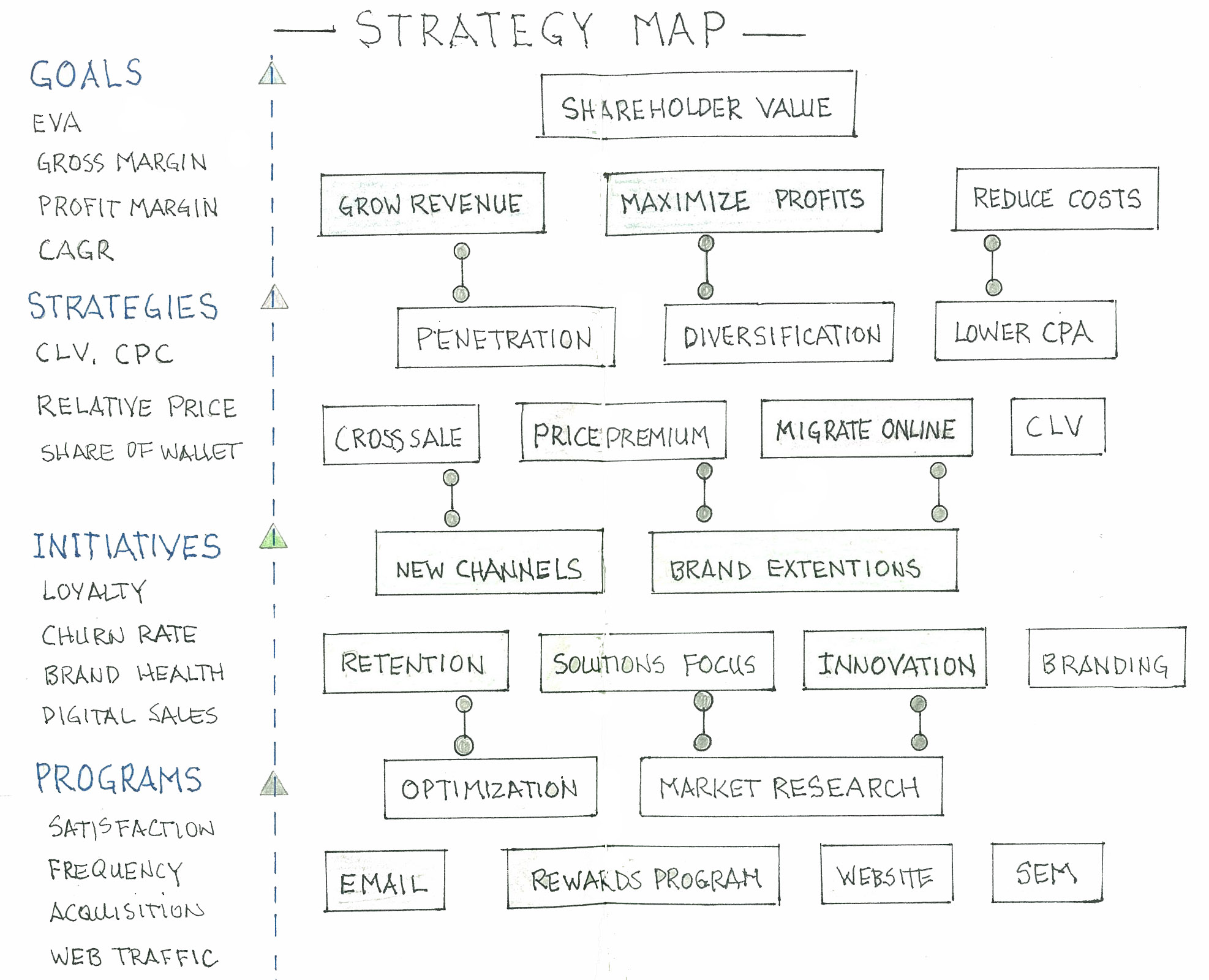

Notebook Thoughts – Mapping Marketing ROI

Mapping marketing ROI should always start by defining business goals and measures of success. Marketers should then align programs, initiatives and strategies to the theses goals—with each category having its own benchmarks and goals. These measures should fall into two categories: measures of success and leading indicators to these measures of success.

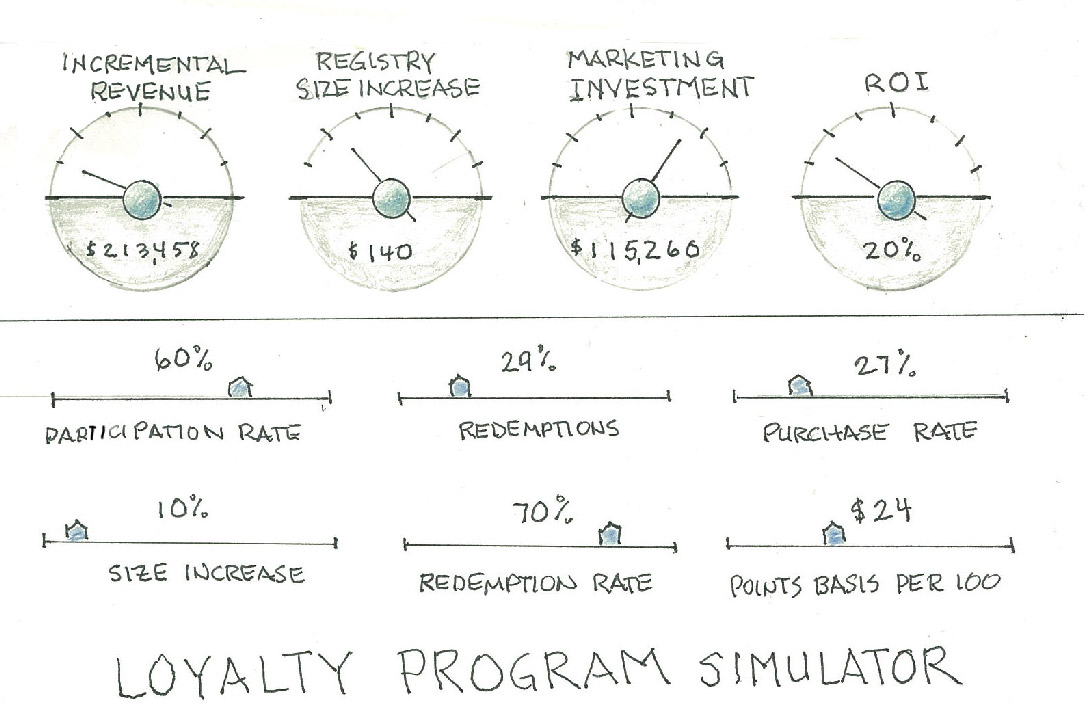

Notebook Thoughts – Building a Loyalty Program Simulator

When possible, brands should use simulation to forecast the ROI of marketing programs and initiatives. The above is a sketch/draft of a loyalty program simulator I crafted for one of the largest home furnishings brands in the world.

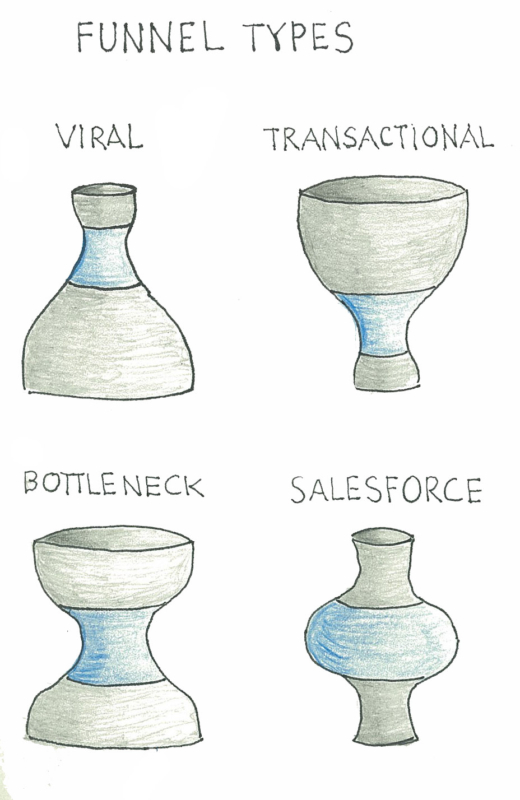

Notebook Thoughts – Understanding Marketing Funnel Types

Although it is important that brands define customer relationships through the lens of the consumer journey, it is helpful sometimes to think of funnels when trying to optimize customer acquisition. Brands lacking a strong acquisition strategy tend to fall into one of four funnel types: Transactional, Viral, Salesforce, Bottleneck.

Transactional – Typically commodity, price-inelastic brands with focus on a low cost product or service but not a quality product nor user experience.

Viral – A popular product or service where the brand is unprepared to handle the high demand. Products are often out of stock or ecommerce website crashes because it cannot handle volume. Customer support also falls short.

Salesforce – Typically a B2B brands where transactions are driven by its salesforce but lacks both a strong marketing strategy or product/customer support.

Bottleneck – This is the opposite of the Salesforce Funnel. Where marketing and customer support are very strong but the salesforce infrastructure cannot handle the volume of transactions.

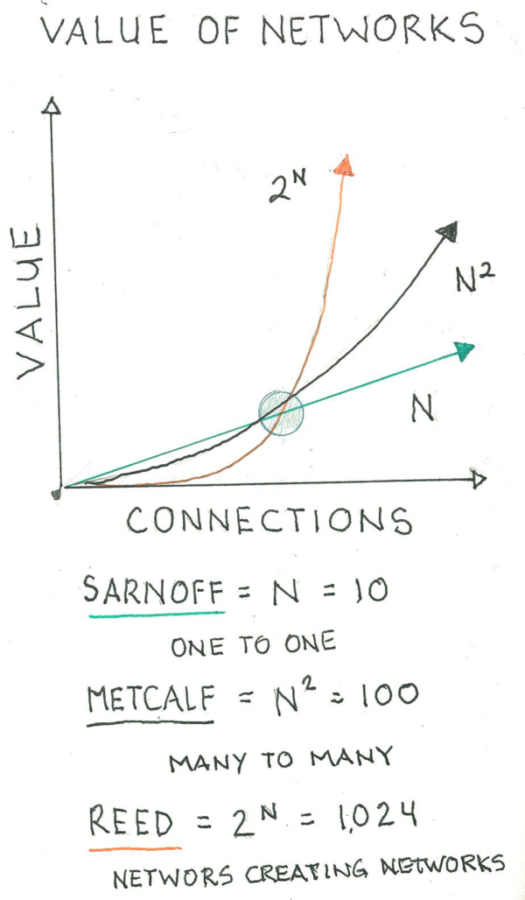

Notebook Thoughts – Understanding the Value of Social Netoworks

To understand the potential of today’s interconnected world, it is important to understand the law of networks have evolved over the past century.

Sarnoff –

Metcalf –

Reed –

Crunch or Be Crunched

90 PERCENT OF THE WORLD’S DATA WAS CREATED IN THE LAST TWO YEARS

Given the sheer volume of marketing data out there, you can’t afford not to have a data-mining strategy. Data are at the core of today’s technology revolution. Every day we create 2.5 quintillion (1018) bytes of data – so much that 90 percent of the world’s data today has been created in the last two years alone–and 90 percent of that data is unstructured. Internet devices, mobile phones, network and satellite television, traditional and satellite radio and other digital media make possible more targeted, frequent contact with the masses. At the same time, whether collected at the cash register or through the Internet, companies are amassing troves of consumer data. This demographic, geographic and psychographic data should be fully exploited to help companies predict consumer behavior and preferences.

The collection and use of customer data to optimize marketing efforts are nothing new. In the 1920s, General Motors discovered that loyalty among Ford vehicle owners was very low—a Ford driver was not likely to purchase his second vehicle from Ford. So General Motors began surveying these drivers to collect data and develop insights into customer preferences. These insights were then used to develop marketing campaigns that targeted Ford vehicle owners. Today, data-centric companies like online retailer Amazon.com in the U.S. and brick and mortar retailer Tesco in the U.K. rely on mathematical modeling to ensure that the right products are offered to the right consumers at the right time. For instance, Tesco’s deployment of its loyalty-card program and the resulting data gathered from its users are credited with helping Tesco fight off Wal-Mart’s entrance into the U.K. market. The data collected is used to tailor marketing programs for its customers. For example, Tesco customers who buy diapers for the first time receive offers for baby wipes, toys and beer—as data analysis show that new fathers are more likely to drink at home. Tesco’s loyalty-card program is so successful that major consumer products companies buy reports based on data collected and analyzed by Tesco.

Companies are also leveraging technology and analytics to target, track and optimize marketing campaigns. For example, Dell uses campaign management tracking software to track near real-time responses to its online, direct-mail and print advertising. Analysis of the data collected allows Dell to continuously optimize its marketing efforts, resulting in a higher return of marketing dollars invested.

By no means are companies the only ones benefiting from today’s data-rich world. Consumers have more data and information at their fingertips than ever before. They are just a few clicks away from the best mortgage rates or the entire collection of the Library of Congress. The last few years have seen the proliferation of Internet companies that provide pricing and product information for millions of items and services in a fraction of a second. Without leaving the comfort of a chair, a buyer can determine which companies offer the lowest prices, free shipping, etc. However, unbeknownst to most consumers, the data flow is often two-way. Most of these companies collect data on site visitors for their own use. Google, Yahoo! and MSN, for example, keep a record of every search ever made through their search engines. The data collected includes the IP address of the person doing the search, keywords entered, results returned by the search engine and websites visited. Other sites, like pricegrabber.com and pricescan.com, play both sides of the fence. They provide product data to consumers and consumer data to companies—by tracking consumer shopping behavior on their websites.

As marketers continue to embrace new technologies and channels such as mobile and IPTV, they will be inundated with even more data. The industry leaders of the future will be those who are able to collect and mine this data to understand and predict individual consumer behavior. However, it seems that many companies still have a long way to go before they fully embrace analytics, CRM techniques and other measurable marketing strategies. In a survey conducted by Epsilon, only 30% of CMO’s said they agree with the statement “You use sophisticated modeling tools to analyze existing customer data (behavioral, preference and demographic).‘’ And this in spite of the fact that almost 70% of CMO’s are generating more data than ever before by increasing their spend on digital advertising and social media.